North Indian Pandit In Bangalore

NORTH INDIAN PANDIT IN BANGALORE

Are you looking for North Indian Pandit in Bangalore? Here you get all types of Puja Services in Bangalore with 55% OFF Disscounted price.Hindi Pandit,Bihari Pandit,UP Pandit,Mythila Pandit and all types of puja pandit available here Rudrabhishek Puja, Satyanarayana Pujan,Grihpravesh Pandit and all types of Puja available here you can book your pooja from fill the form or inquiry now and contact us through phone.

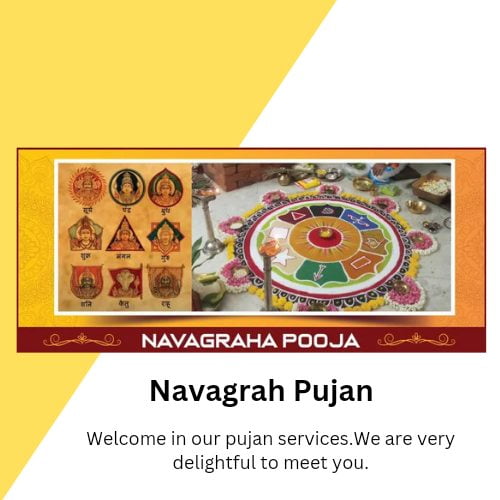

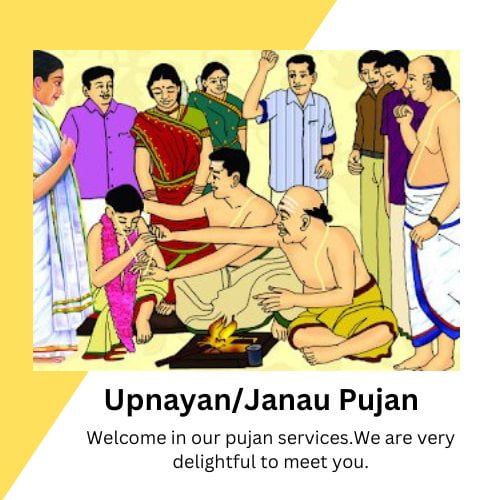

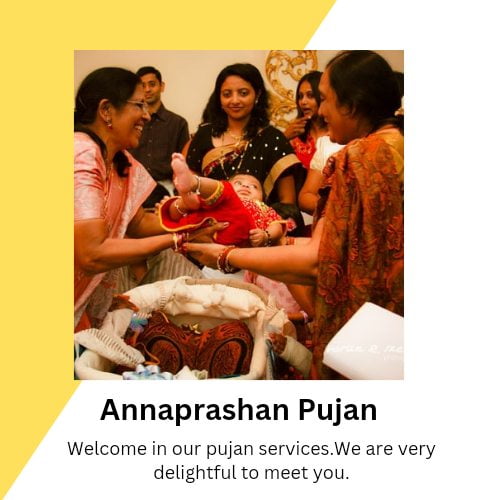

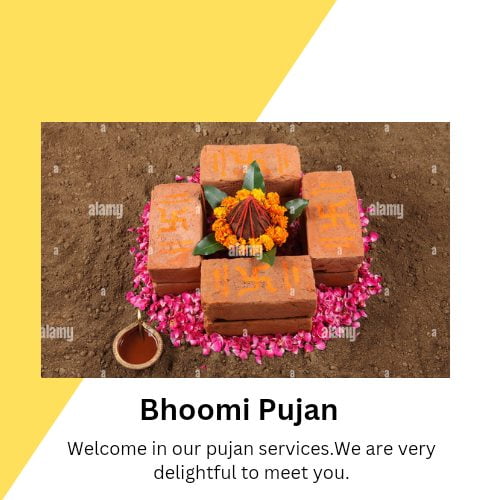

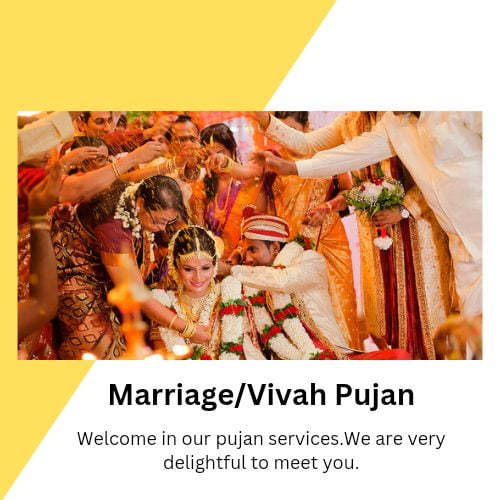

OUR PUJA SERVICES

North Indian Pandit In Bangalore

Book your pooja with all puja samagri.Quality Puja experience.Near your places.siyaram pujan providing all types of POOJA with pujan samagri.Hindi Speaking and other language puja pandit providing us. Hurry UP! CALL-9140962832.

Book your Pooja Now.Book verified trusted and experienced NORTH Indian PANDIT IN BANGALORE at very affordable Price.

At Siyaram Pujan, we take great pride in offering authentic and traditional Pooja services conducted by experienced North Indian pandit IN BANGALORE right here in the vibrant city of Bangalore.

Our mission is to bring the spiritual richness of North Indian culture and traditions to your doorstep, ensuring a meaningful and blissful Pooja experience.North Indian Pandit in Bangalore.

North Indian Pandit In Bangalore

Whether it’s for spiritual guidance, personal well-being, or celebrating special occasions, SiyaramPujan is here to make your Pooja experience truly memorable. Contact us today to schedule your Pooja service and experience the rich traditions of North Indian culture in the heart of Bangalore.North Indian Pandit in Bangalore

Visit our website at www.siyarampujan.com to explore our services, get in touch with our expert pandits, and embark on a soulful journey of devotion and spirituality. We look forward to serving you and making your Pooja experience a divine one.North Indian Pandit in Bangalore.We also available on facebook-SIYARAM PUJAN

Book Pandit Ji Now-9140962832

A North Indian Pandit in bangalore is a Hindu priest trained in the rituals, traditions, and ceremonies specific to North Indian culture.

Hiring a North Indian Pandit in bangalore ensures that the ceremonies are performed according to the specific customs and traditions of North India, maintaining cultural and religious authenticity.

North Indian Pandits can perform various ceremonies such as weddings, Grah Pravesh, Satyanarayan Katha, Janeyu (Upanayan), and other religious rituals.north indian pandit in bangalore.

You can find a North Indian Pandit in Bangalore through our website, by filling out an online booking form, or by contacting us via phone or email.

Yes, North Indian Pandits are available to perform Poojas at your home, ensuring a personalized and convenient religious experience.north indian pandit in bangalore.

Yes, North Indian Pandits are available to perform Poojas at your home, ensuring a personalized and convenient religious experience.

Yes, many North Indian Pandits provide all necessary Pooja materials. However, you can choose to arrange them yourself if you prefer.

Yes, North Indian Pandit in bangalore are experienced in performing Poojas for all major Hindu festivals such as navratri,ganesha, Diwali, Holi, Raksha Bandhan, and Navratri.

Yes, we offer virtual Pooja services where the Pandit performs the rituals online, guiding you through each step.north indian pandit in bangalore.

Yes, North Indian Pandit in bangalore can perform special Poojas for occasions such as birthdays, anniversaries, and new business ventures.

It is recommended to book at least 3-5 days in advance to ensure availability, especially during peak seasons.north indian pandit in bangalore.

Yes, North Indian Pandits explain the significance and procedures of each ritual, ensuring that you understand and appreciate the spiritual aspects.

The cost varies depending on the type and duration of the Pooja. Please contact us for detailed pricing information.

NORTH INDIAN PANDIT IN BANGALORE

Are you looking for North Indian Pandit in Bangalore? Here you get all types of Puja Services in Bangalore with free Pooja Samagri not any extra cost, Hindi Pandit in Bangalore,Bihari Pandit in Bangalore,up Pandit in Bangalore,mythila Pandit in Bangalore,Rudra Avishek Pooja Pandit in Bangalore, Satyanarayana Katha Pooja Pandit Bangalore all types of Pooja available here you can book your pooja from fill the form or inquiry now and contact us through phone.

Why Choose SiyaramPujan?

- Experienced Pandits: Our team of dedicated and knowledgeable pandits has years of experience in conducting Poojas and rituals.

- Affordable Pricing: We offer competitive pricing without compromising on the quality of our services.

- Trusted and Reliable: SiyaramPujan is a trusted name for Pooja services in Bangalore, ensuring reliability and authenticity.

- Convenient Booking: You can book our services easily through our website, ensuring a hassle-free experience